Why should you be interested in investing in commercial lots? Here are 4 excellent reasons:

1. Opportunity to Create the Highest and Best Use

One of the biggest benefits of buying vacant land is the freedom to create the property you want. Although it may require foresight, as you would need to determine what the best use of the property would be in your particular area, it also allows you to get creative.

Of course, many zoning restrictions are already set, so you would have to either adhere to them or go through the proper channels to have them changed.

2. Direct Ownership

Buyers of vacant land typically pay with cash, which would enable them to have full/direct ownership. Owning the land outright can bring peace of mind, especially since it’s a tangible asset that doesn’t wear out. Plus, you would avoid things like mortgage interest and loan origination fees typically charged by the bank.

3. Less Maintenance

Vacant land is much easier to manage remotely than rental properties are. Many of the maintenance concerns of a rental (i.e. plumbing, electrical, common areas, etc.) don’t apply to vacant land. There’s typically less vandalism as well.

4. More Affordable Than Developed Land

It’s usually cheaper to own as a long-term investment, especially since property taxes and fees are often lower than they are on developed land.

Also, sellers of vacant land are usually more motivated to sell, so you can get a lower price. You may even get seller financing. The affordability can be a game changer.

For example, when I purchased the vacant land for my vacation home, the land value went up in time between when I purchased it and when I developed it. I was able to use it as collateral for the construction loan, which I was eventually able to convert to a conventional mortgage without refinancing. When the project was completed, my total cost for the land and development was much lower than the retail value of the property.

Please contact either Dave or Josie and they will personally assist you with all of your purchasing, selling, leasing, upgrading, construction or investment needs. From start to finish, they will be in your corner. StoragePartners.us

JOSEPHINE HART

Office: 561-235-5734

Mobile: 770-880-5309

josephine@storagepartners.us

DAVID FEGLEY

Mobile: 515-208-9205

Fax: 563-594-5202

dave@storagepartners.us

Why Self Storage Investments Beat Most Other Real Estate

Self storage investments can be thought of as the misperceived, often forgotten younger sibling of commercial real estate investing. I mean, what’s so interesting about them? Some sheet metal, some rivets, and a floor, how could that be enticing to an investor? If you look a little deeper, you can see that self storage investing is one of the most profitable value-add opportunities in the entirety of not only commercial real estate but real estate as a whole. Paul Moore was under this same misconception when he first switched from apartment investing to investing in self storage facilities. Now, Paul knows exactly why this slept-on asset class is one of the most profitable forms of real estate in existence. If you’ve been itching to get your foot in the door to commercial real estate investing, grab Paul’s latest book from BiggerPockets, “Storing Up Profits”!

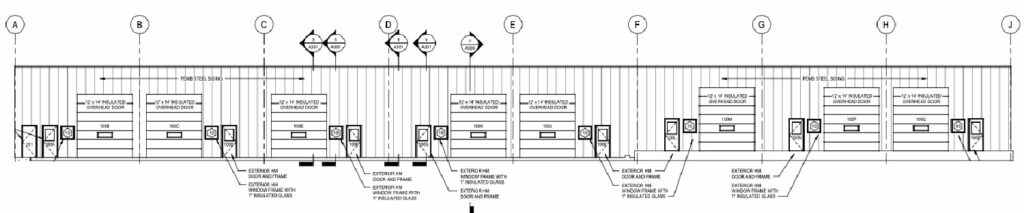

Commercial Flex Lease Space Available in Des Moines, IA

Zoned: Commercial / Light Industrial

Contact us at 515-988-7878

★ AVAILABLE NOW! / COMPETITIVELY PRICED!

5484 NE 17th St, Des Moines, IA 50313

Explore the perfect space to elevate your business! This exceptional commercial lease opportunity is just 6 blocks from the Interstate 80 and Interstate 35 Interchange.

★ Strategically located for fast access to I80 and I35 interchange.

★ Property Features:

• Total Space: 3,150 sq ft

• Price: $12 per sq ft plus CAM

• Office Space: 300 sq ft

• Bathroom with Shower

• Overhead Door: 12′ x 16′

• Heated and Air Conditioned

• Clear Height: 18′

• Fire Sprinkler System

• LED Lighting

• Floor Drain: 12′

• Built in 2017

• Fiber Internet Available

• Zoned Light Industrial

• Locally Owned and Managed

• Ample Parking – Large enough to turn a semi truck around

• American Owned and Operated Company

Ready to take the next step? Reach out to us for inquiries or to schedule a tour at your convenience.

● Contact us at 515-988-7878

● www.ironmanproperties.us for photos & more info

Don’t miss this prime commercial lease opportunity. Your business deserves the best, and we’re here to make it happen!

5484 NE 17th St, Des Moines, Iowa 50313

Unlocking the World of Angel Investing: High-Risk, High-Reward Adventures

Angel investing, often described as the wild west of the investment world, allows individuals to stake their own hard-earned money into startups, bypassing traditional funds or venture capital. These daring investors, often high net worth individuals, make personal bets on the future success of innovative companies. Traditionally, this playing field was reserved for those with deep pockets, typically requiring minimum checks of $25,000 or more. But with the rise of crowdfunding and syndicates, angel funding has become accessible to a broader audience, opening doors for investments as modest as a few thousand dollars or even just a couple of hundred dollars. The democratization of angel investing is an exciting development, making it more inclusive and diverse than ever before.

In the world of angel investing, you have the freedom to set your criteria for investments, aligning them with your personal interests and values. This flexibility means it’s not just about financial returns but can also focus on environmental benefits, health advancements, or specific industries. This personalized approach allows investors to place a thumb on the scale in favor of companies that resonate with their passions, potentially fostering a positive impact on the world while pursuing profits.

When you invest as an angel, you’re not just purchasing shares; you’re buying a significant piece of the company. Unlike the stock market, where a single share in a giant corporation might translate to a minuscule ownership percentage, angel investors can own a substantial portion of a startup. In some cases, this ownership could reach 10%, 20%, or even 30% of the company in exchange for their investment. However, there’s a catch – it’s not liquid. Angel investments are typically locked in for five to seven years or more, with limited opportunities to sell. While secondary markets are emerging, they are primarily accessible to well-established, successful companies. This long-term commitment adds an element of adventure and risk to angel investing.

In angel investing, you’ll often acquire preferred stock, providing additional protections as an investor. However, during pre-seed rounds, you might not get actual stock; instead, you’ll receive convertible notes or a SAFE (Simple Agreement for Future Equity). These instruments allow you to bypass complex negotiations and focus on the valuation. You’ll convert your investment into stock in a later round, benefiting from their negotiated terms.

Your payout in angel investing comes when the startup exits, either through an initial public offering (IPO) or an acquisition, the more common outcome. The key here is a high valuation. If the startup you’ve invested in is worth substantially more at exit than when you invested, you can potentially reap significant returns. However, not all startups are positioned for these grand exits, making it crucial to choose your investments wisely.

If your cousin approaches you to invest in their car wash franchise, it may not align with the typical angel investment profile. Angel investing thrives when there’s a clear path to a high-valuation exit event, often involving millions or billions of dollars. For long-term businesses without exit plans, other investment options might be more suitable.

It’s essential to understand that angel investing is a high-risk venture. On a per-investment basis, between 80% and 90% of startups may not return your initial investment. Many may go bankrupt, some may provide minimal returns, and occasionally there’s an acquihire where founders are hired, giving investors a modest return. This underscores the importance of setting aside funds you’re comfortable losing because angel investments are locked in for several years. However, the upside potential is enormous. A successful angel investment can multiply your initial investment by 20 times or more, with some of the best investments returning thousands of times the initial stake. The allure of these potentially life-changing returns is what attracts investors to the game.

Angel investing is a numbers game; you can’t rely on being right about a single investment. Instead, it’s about diversifying your portfolio and ensuring that the winners outweigh the losers. While a crystal ball for predicting successful startups remains elusive, careful selection and portfolio management can improve your odds.

Most angel investments are made in very early-stage companies, often at the pre-seed or seed stage. These companies are usually pre-revenue or have only recently launched their products. Investing in companies at this stage comes with significant risk, but it’s also where the potential for massive growth lies.

Valuations for angel investments typically range from $1 million to $10 million, though recent inflation may push them higher. As an angel investor, your role is to help these companies refine their products, accelerate growth, and position them for success.

Unlike traditional stock investments where your involvement is minimal, angel investing offers you the opportunity to actively contribute to the startups you back. Companies often seek input and expertise from their angel investors, who can provide valuable insights, connections, and hands-on support, making the experience incredibly rewarding.

The world of angel investing is a thrilling one, offering you the chance to engage with startups, be part of their journey, and potentially reap substantial rewards. So, if you’re ready to dive into the world of angel investing, stay tuned for our upcoming articles, where we’ll guide you on how to get started, delve deeper into the economics, and explore the strategies for making wise angel investments. Happy investing!

#AngelInvesting #StartupInvestment #HighRiskHighReward #VentureCapital #Democratization #PortfolioDiversification #InvestmentStrategies #InvestorInsights #EarlyStageStartups #FinancialAdventures #StartupEcosystem

Loss Prevention & Loss Recovery for Self Storage Facilities with David Fegley & Josephine Hart at StoragePartners.us

Self-storage facilities are witnessing a groundbreaking era in revenue recovery, with operators achieving unparalleled success. According to some estimates, operators are surpassing all expectations, achieving

Unlocking Opportunities: A Practical Guide to Successful Lot Investing

Unlocking Opportunities: A Practical Guide to Successful Lot Investing Investing in lots has emerged as a lucrative opportunity for astute investors seeking to diversify their

Altoona Iowa is growing fast with new commercial zones and large investments.

In January 2022, the City of Altoona issued 8 commercial and 19 residential building permits, representing more than 44,020 square feet of new or improved space and over $6 million invested. In January 2022, the City

Here are the top 5 reasons you should be investing in Commercial Real Estate right now!

Success occurs when your why, when your dreams, are bigger than your excuses. And when the why is powerful, then the how-to is not so difficult. One of the privileges I have as a mentor is learning what motivates people to invest in commercial real estate.

- Walk Away Money: They want to use commercial real estate as a vehicle to create walk away money so they can walk away from their job. Very powerful why.

- Create Generational Wealth: Investing in commercial real estate to leave a legacy for your family. Commercial real estate can change lives. It can change generations by creating generational wealth.

- Get Time Back: We have many students that work six days a week, ten hours a day, to put food in the table. They don’t have time for anything other than work. Work is very honorable, but they desire to do a different type of work, that allows them to spend time with their family.

- Want Options: Commercial real estate investing gives you more options in how you live your life. You can work part-time, and pursue other interest like volunteering, traveling or going on a missions trip.

- Switch from Single-Family Investing: This why may resonate with those of you who have been investing in single family homes for the purpose of creating cash flow for retirement. Some of our protege students have bought 10, 20, sometimes up to 30 homes and still come to us because they have no cash flow.

Here are the top 5 lame excuses people give for NOT investing in Commercial Real Estate and how to get past them so they don’t hold you back from achieving your goals in commercial real estate.

JOSEPHINE HART

Office: 561-235-5734

Mobile: 770-880-5309

josephine@storagepartners.us

DAVID FEGLEY

Mobile: 515-208-9205

Fax: 563-594-5202

dave@storagepartners.us